Our lending hub gives you groundbreaking and seamlessly simple ways for you to offer customers the financial products to help them manage their finance and wellbeing.

Lending Hub core solutions

The three core customer solutions in our Lending Hub product, all seamlessly integrate with your legacy systems. They can be offered to your customers or employees via web or mobile apps, and can be up and running in weeks.

Salary-linked

Lending products

Lower risk lending products offer you more choice, plus the opportunity to break into different markets by being more competeitve and cheaper.

Personal

finance

Customer facing financial service products developed to suit the busy lives your customers live, with decisions in seconds not hours.

Home

finance app

Offers your customers the ability to: find the property they want, organise a viewing and get an approved mortgage in an instant without even getting out of bed.

Salary-linked lending products

The Salary Access core solution offers a groundbreaking new app that gives you greater choice to offer products that help customers to stay in control of their finances, beat off high interest debts, avoid extortionate payday lenders and save for longer-term financial freedom. Businesses on average lose £450,000 for each 1000 of their staff who are in financial difficulty every year. Our solution tackles this head on.

£450,000

Is the amount that each business loses for every 1000 of their staff who are in financial difficulty every year. Our solution tackles this head on.

20.3m

employees (3 in 5) are struggling with money

52%

regularly use credit cards, overdrafts and payday loans for basic everyday needs

45%

of people run out of money

between paydays

Help your staff overcome the financial

impacts of COVID-19

Empower your employees to take control of their finances and reduce the need for expensive debt and credit—without impacting payroll. Once you help them to get control of their finances they will be more loyal, they will be happier and they will be more productive.

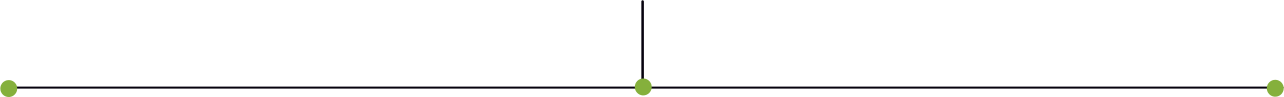

How does it work:

Track and access salary earned

Give your customers more transparency, flexibility and control over how and when they get paid so they can budget better, without having to rely on expensive debt and credit to make it through to the next payday.

Tailored usage controls and reporting

Set bespoke rules around how much, how often and what type of pay advances customers can access.

Nurturing healthy habits

Help customers say goodbye to money worries and hello to a happier, healthier financial life with ‘nudges’ and a wealth of app based, easy to understand tools, tips and articles.

What businesses tell us

Our customers tell us that when they implement Salary Access core from Lending Hub they very quickly see:

More shifts booked

More people arriving for work

More minds on the job

Higher job satisfaction

Greater staff retention

Generally happier workforce

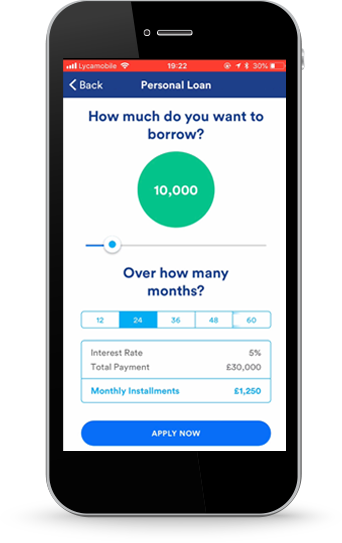

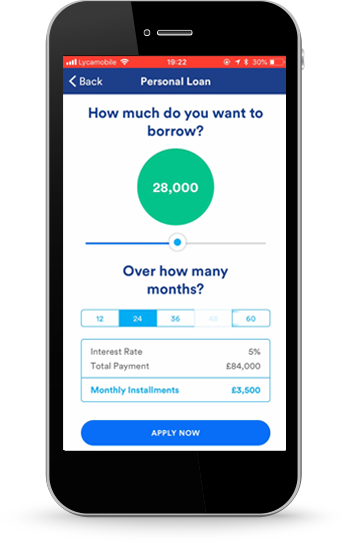

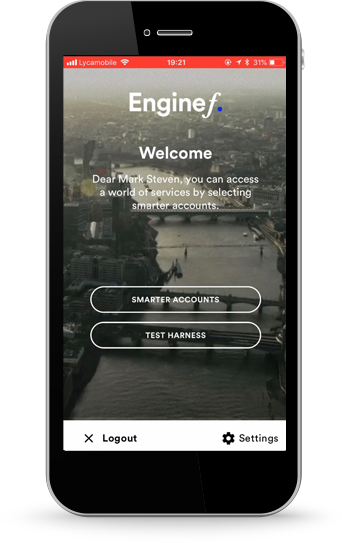

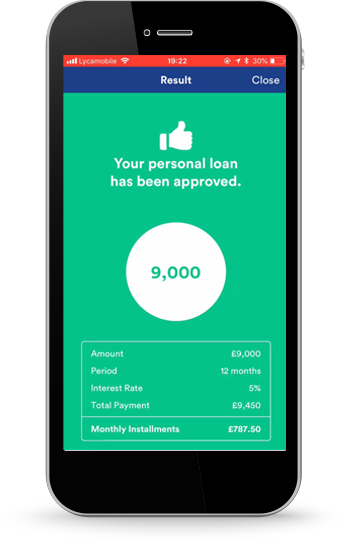

Personal finance

The personal loan app from Enginef allows loans to be decided on in seconds, with a very easy to use interface, immediate decisions and money in your bank within minutes. This is the app all your customers want to be using.

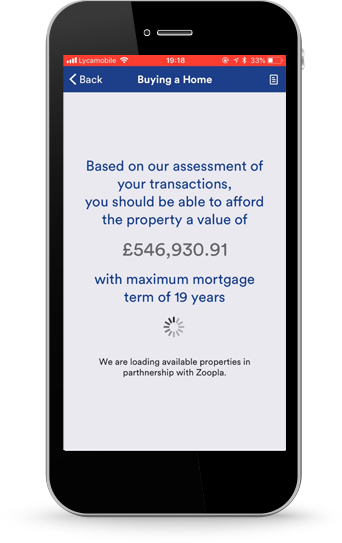

Home Finance app

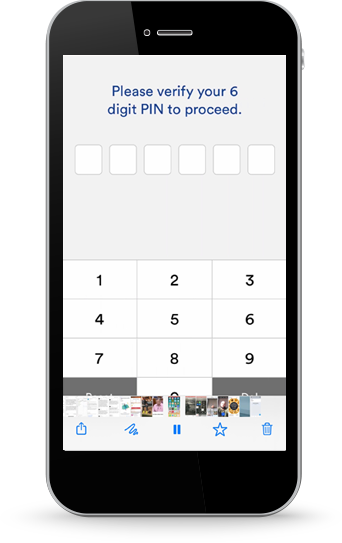

Secure Authentication

Linking directly to your bank via secure PSD2 Open Banking & Other Integrations, you can access all your financial needs quickly and safely.

Instant lending limits revealed

Our clever algorithms will assess your lending limits based on your banking habits and transactions. To ensure you can get the mortgage you need.

Direct links to Estate Agent API’s

You’ve got your mortgage, now find the house of your dreams, all without leaving the app, direct API links to Estate Agents give you the flexibility at your fingertips to be in control of your house purchase.

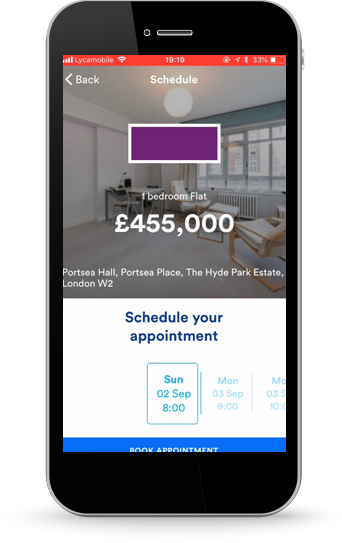

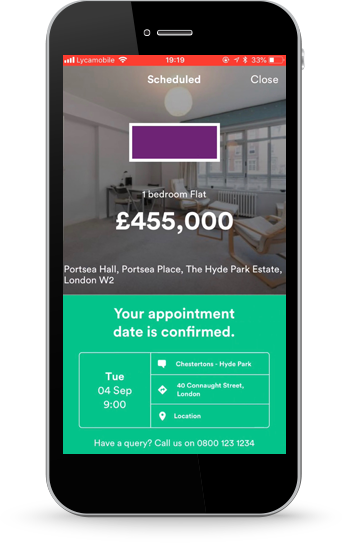

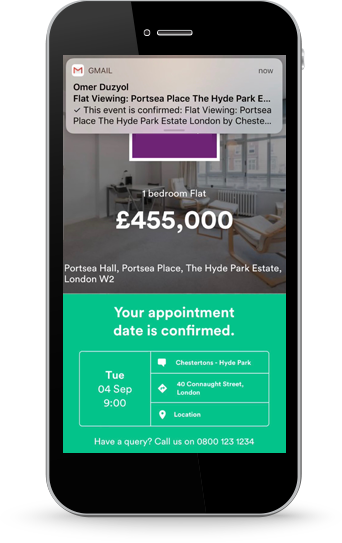

Easily organise your preferred viewing time slots

Using the scheduler you can even organise a viewing that suits you and get immediate confirmation.